The Impact of Beta Techno 1996 on Financial Services

In the realm of financial services, innovation is paramount. One key milestone that significantly shaped the industry is the emergence of beta techno 1996.

Understanding Beta Techno 1996

The term beta techno 1996 refers to a transformative period that introduced groundbreaking technologies into the business landscape. This era emphasized the importance of adopting new technologies to improve efficiency, enhance customer experience, and drive profitability.

Technological Milestones

During this time, businesses began leveraging various digital tools and software to optimize operations. Key developments included:

- Automated Trading Systems - These systems allowed for faster, more efficient trading, reducing human error and increasing transaction volume.

- Online Banking Platforms - Financial institutions started offering online banking services, providing customers with 24/7 access to their accounts.

- Data Analytics Tools - Companies began utilizing data analytics to gather insights, better understand customer behavior, and tailor services accordingly.

The Role of Innovation in Financial Services

Innovation is a driving force in financial services. Embracing technological advancements like those from beta techno 1996 can dramatically enhance service delivery and customer satisfaction. Here’s how:

Enhancing Customer Experience

Today's consumers expect seamless experiences. By implementing the technologies that originated from the beta techno era, businesses can:

- Offer Personalized Services - Use customer data to provide tailored financial solutions.

- Streamline Customer Interactions - Through chatbots and virtual assistants, companies can address customer inquiries swiftly.

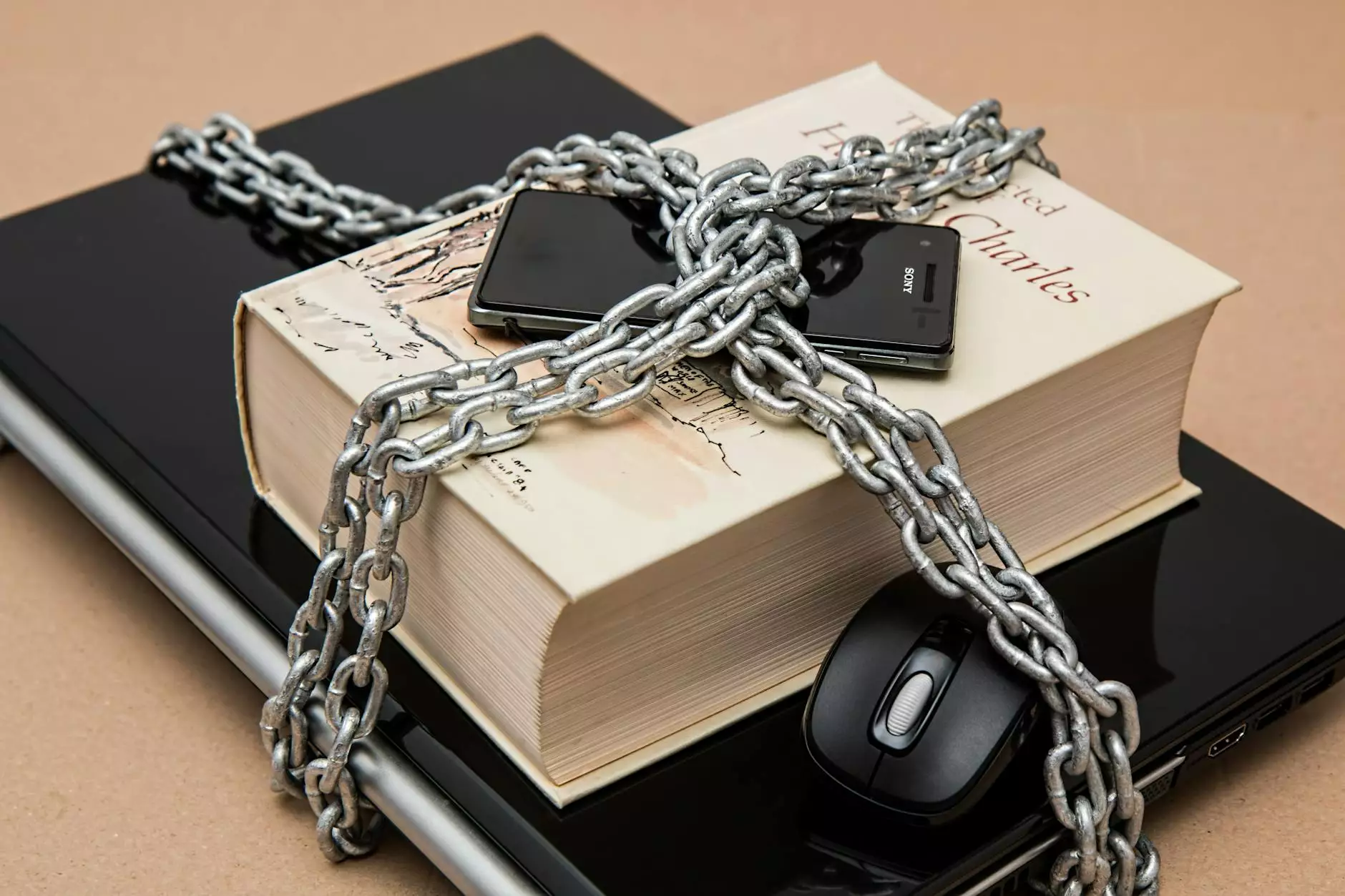

- Improve Transaction Security - Advanced encryption technologies ensure that customers' data remains secure.

Case Study: Visa-car.com

One exemplary organization that has embraced innovation is Visa-car.com. Their commitment to leveraging technology has transformed how they operate within the financial services industry.

Financial Solutions Offered

Visa-car.com provides a variety of financial solutions that reflect the innovations initiated during the beta techno era. Some of their offerings include:

- Flexible Financing Options - Visa-car.com offers a range of financing solutions tailored to individual needs.

- Advanced Online Tools - The platform allows users to calculate potential financial commitments easily through intuitive online calculators.

- Dedicated Customer Support - Their customer service team is readily available to assist clients, utilizing both traditional communication methods and modern digital channels.

Adapting to Market Changes

As the financial sector continues to evolve, Visa-car.com is well-positioned to adapt to market changes thanks to the foundational innovations of beta techno 1996. Some strategies they implement include:

- Continuous Education and Training - Keeping staff updated on the latest technology and regulatory changes ensures they remain competitive.

- Regular Technology Updates - Investing in the latest software solutions guarantees that operational processes are efficient and customers are satisfied.

- Feedback Loops - Collecting customer feedback regularly helps the organization improve its services and adapt to client expectations.

The Future of Financial Services

As we look forward, it is evident that the legacy of beta techno 1996 will continue to influence the financial services landscape. The integration of advanced technologies like artificial intelligence, blockchain, and machine learning are just a few examples of what lies ahead.

Anticipated Trends in Financial Services

Based on current trajectories, we can expect several trends to reshape the financial sector:

- Increased Automation - Businesses will continue to automate processes, reducing costs and improving accuracy.

- Greater Emphasis on Cybersecurity - Protecting consumer data will become a paramount concern as threats evolve.

- Personal Finance Management Tools - Clients will seek out tools to help them manage their finances effortlessly and efficiently.

Conclusion: Embracing the Future of Financial Services

The advancements stemming from beta techno 1996 have laid a powerful foundation for today's financial services. Companies like Visa-car.com exemplify how embracing innovation can lead to better customer experiences and streamlined operations. In this ever-evolving landscape, organizations that prioritize technology and customer-centric strategies will not only thrive but will set the standard for excellence in the industry.

In conclusion, as we reflect on the evolution of financial services, it's clear that the next chapter will be characterized by ongoing innovation and a steadfast commitment to meeting the needs of consumers in an increasingly digital world. The journey initiated by beta techno 1996 is far from over; it is a stepping stone towards a future rich with potential and opportunity.